| ||

GST has been continuously evolving since July 2017 into a robust tax regime with minimum confusion on the Act and also on the Rules front. There is a clear differentiation on the powers of the State and the Centre though numerous taxes were subsumed alongwith the import/export of goods/services which, hitherto, was an exclusive domain of the Centre. The rewriting of the vital articles of the Constitution alongwith the solid support from all the States has made this possible.

One of the areas that can be an Achilles heel is the import/export of goods and services. The reason being that the state Govt also will get to hold on the taxation of the import/export of goods/services under the provisions of IGST act. This is made possible by the division of 90% of the taxpayers under Rs. 1.5 crores and 50% of the taxpayers beyond Rs. 1.5 crores being placed under the control of the respective jurisdictional state Governments.

The levy on the import of goods/services is created under the provisions of section 5 of the IGST act which states that all inter-state supplies will attract IGST. This has to be read alongwith the provisions of section 7(2) and 7(4) of the IGST act which states that supply of goods/services that imported into the territory of India shall be treated as inter-State trade or commerce. Further 'Supply' has been defined under section 7 of the CGST act 2017.

Once the levy is created then the modalities of the taxation and the person who will be liable to pay the IGST. The taxation of the import of goods is governed by the Customs act 1962. But in respect of services imported into India the three provisions that govern the taxation will be section Section 7(1) (b) of the CGST act 2017, entry No. 4 in the Schedule I of the CGST act 2017, section 2(14) of IGST at 2017, section 2(15) of the IGST act 2017 and section 13 of the IGST act 2017. But primarily the provisions of the section 7 of the CGST at has to be understood thoroughly for clarity.

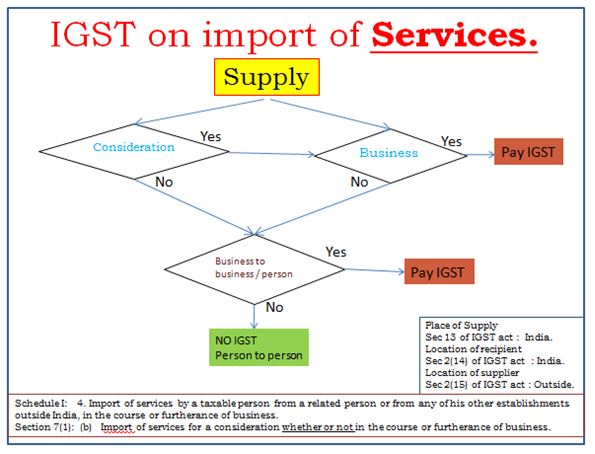

Though the provisions are many the taxation of the import of services taking into account all the above provisions can be summarised in a chart which can be easily studied and understood. The terms 'whether or not in the course of Business' under section 7(1)(b) of CGST act and 'without consideration' under schedule I of CGST act under the definition 'Supply', and 'in the course of inter-State trade or commerce' can lead to confusion. Hence the chart appended below summarises the important provisions of law and the concepts that decide the levy of IGST on the import of services.

It is to be understood that any transaction of import of services from business to business, business to person and finally person to business are taxable under the IGST act regime. As indicated in the above chart the IGST would not be payable for the import of service from non-taxable person to non-taxable person where there is no consideration and the said service is not used for any business purpose. Eg. I get a house building plan from my friend or relative who is not in the said business and I do not pay any consideration and I do not sell the plan to any other person. Hence the above chart is an effort to reflect the simple provisions of the GST regime for the import of services.

|

Sunday, March 1, 2020

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment