Ethics is built on individual perceptions

Read more at: https://www.deccanherald.com/content/18435/ethics-built-individual-perceptions.html

Read more at: https://www.deccanherald.com/content/18435/ethics-built-individual-perceptions.html

ASATOMA SADGAMAYA. LOKAASAMASTHA SUKHINO BHAVANTU.

| ||

GST has been continuously evolving since July 2017 into a robust tax regime with minimum confusion on the Act and also on the Rules front. There is a clear differentiation on the powers of the State and the Centre though numerous taxes were subsumed alongwith the import/export of goods/services which, hitherto, was an exclusive domain of the Centre. The rewriting of the vital articles of the Constitution alongwith the solid support from all the States has made this possible.

One of the areas that can be an Achilles heel is the import/export of goods and services. The reason being that the state Govt also will get to hold on the taxation of the import/export of goods/services under the provisions of IGST act. This is made possible by the division of 90% of the taxpayers under Rs. 1.5 crores and 50% of the taxpayers beyond Rs. 1.5 crores being placed under the control of the respective jurisdictional state Governments.

The levy on the import of goods/services is created under the provisions of section 5 of the IGST act which states that all inter-state supplies will attract IGST. This has to be read alongwith the provisions of section 7(2) and 7(4) of the IGST act which states that supply of goods/services that imported into the territory of India shall be treated as inter-State trade or commerce. Further 'Supply' has been defined under section 7 of the CGST act 2017.

Once the levy is created then the modalities of the taxation and the person who will be liable to pay the IGST. The taxation of the import of goods is governed by the Customs act 1962. But in respect of services imported into India the three provisions that govern the taxation will be section Section 7(1) (b) of the CGST act 2017, entry No. 4 in the Schedule I of the CGST act 2017, section 2(14) of IGST at 2017, section 2(15) of the IGST act 2017 and section 13 of the IGST act 2017. But primarily the provisions of the section 7 of the CGST at has to be understood thoroughly for clarity.

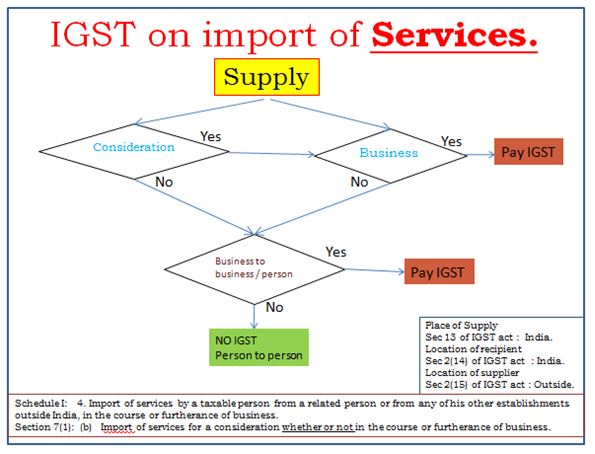

Though the provisions are many the taxation of the import of services taking into account all the above provisions can be summarised in a chart which can be easily studied and understood. The terms 'whether or not in the course of Business' under section 7(1)(b) of CGST act and 'without consideration' under schedule I of CGST act under the definition 'Supply', and 'in the course of inter-State trade or commerce' can lead to confusion. Hence the chart appended below summarises the important provisions of law and the concepts that decide the levy of IGST on the import of services.

It is to be understood that any transaction of import of services from business to business, business to person and finally person to business are taxable under the IGST act regime. As indicated in the above chart the IGST would not be payable for the import of service from non-taxable person to non-taxable person where there is no consideration and the said service is not used for any business purpose. Eg. I get a house building plan from my friend or relative who is not in the said business and I do not pay any consideration and I do not sell the plan to any other person. Hence the above chart is an effort to reflect the simple provisions of the GST regime for the import of services.

|

AS per the provisions of erstwhile 65B(44) of the Finance Act, 1994, any activity by one person to another for a consideration was termed as service for the purpose of levy of service tax. It is known that under the erstwhile Finance Act, 1994 there was one remarkable section in the name of declared services notified as section 66E which had brought into the tax net the activity which could not be called as service under section 65B(44) of the same Act. Interestingly under this section 66E there was one entry (e) which stated - "agreeing to the obligation to refrain from an act, or to tolerate an act or a situation, or to do an act". Hence even if there was no activity by one person to another, if there was a consideration received, then the same was taxable. In effect Govt. wanted a share of money received by a person. Under the ambit of this clause the liquidated damages, notice pay and other events which was not an activity from one person to another would attract service tax.

This entry in section 66E of Finance At 1994 was verbatim imported to CGST Act, 2017 in the form of the entry 5(e) of the schedule II to the CGST Act which read "agreeing to the obligation to refrain from an act, or to tolerate an act or a situation, or to do an act". This was necessary since the events resulting in the receipt of money without any activity by the supplier would not fall under sale, transfer, barter, exchange, licence, rental, lease, disposal as enumerated in section 7(1)(a) of the CGST act 2017. Further under the section 7(1) of the CGST act which enumerated what was supply the expression "supply" includes (d) viz. "the activities to be treated as supply of goods or supply of services as referred to in Schedule II". Hence, if any person receives money in the form of the liquidated damages, notice pay, for forbearance or for not doing any activity the same was made taxable in CGST Act, 2017 as in the Finance Act, 1994. This position was also upheld in a matter before the Maharashtra Appellate Authority for Advance Ruling in the case of Maharashtra State Power Generation Company Limited TOG-248-AAAR-GST-2018 & TOG-35-ARA-GST-2018 wherein it was held that "Liquidated Damages for delay - Specific provision being made for levy of liquidated damages if project completion delayed beyond the scheduled date, appellant agrees to tolerate the delay done by contractor in return for payment of money - Value of work done remains unaltered and no price variation occurs because of liquidated damages - Therefore, liquidated damages falls under Clause 5(e) of Schedule-II of Central Goods and Services Tax Act, 2017 vide HSN Code 9997 attracting GST @ 18% (9% CGST + 9% SGST) under Notification No. 11/2017-C.T. (Rate)/State Tax (Rate) as amended".

It was seen that the headnotes of schedule II stated "ACTIVITIES TO BE TREATED AS SUPPLY OF GOODS OR SUPPLY OF SERVICES". Hence it was opined that this Schedule II cannot specify what activity can be supplies since the same was only to state which activity was to be treated as supply of service or supply of goods in the event of overlapping or dispute between the taxpayer and the Govt. It was also made clear that the entries in the schedule II cannot define supply which was already defined under section 7(1)(a), (b) and (c) of the CGST Act 2017.

The GST Council in its wisdom removed this section 7(1)(d) from the definition of supply in the GST (Amendment) Act, 2018 from 1st February 2019. Further, a new section was introduced viz. 7(1A) which stated "where certain activities or transactions constitute a supply in accordance with the provisions of sub-section (1), they shall be treated either as supply of goods or supply of services as referred to in Schedule II". This makes it clear that what has been classified as "supply" under section 7(1) can be specified to be goods or services under this newly introduced section 7(1A). Hence the entries in the schedule II of the CGST Act cannot be termed as "supply" since the section 7(1)(d) was removed from the expression "supply". CBIC in its PPT released after the amendment also stated that "An activity must first be covered in definition of supply before being treated as goods or services as per Schedule II."

This has resulted in a situation where there is no demand of CGST/SGST on the liquidated damages and the like, since it is not supply as per section 7(1)(a) of the CGST Act even if consideration was received. The immediate implication is that the ruling by the Maharashtra Appellate Authority for Advance Ruling in the case of Maharashtra State Power Generation Company Limited has been negated and rendered infructuous. The Maharashtra State Power Generation Company Limited can, therefore, claim refund of the CGST/SGST paid since the amendment of removing the section 7(1)(d) and inserting section 7(1A) has been done retrospectively from 1/7/2017.

|

"THERE is nothing free in this world except the grace of God". It is well known that the electronic industry and other FMCG sectors have a cut throat competition and goods are sold by the retailers for a very thin or no margin at all. We have seen retailers / advertisers claiming 0% margin sale. Will any dealer who has invested huge amounts to set-up a retail sales outlet sell goods without profit? Recently a friend of mine who is a retailer for a printer manufacturer proudly claimed to have got an all-expenses-paid trip to Thailand for exceeding the sales target. It is well known that every electronic goods dealer/ retailer receives benefits not specified anywhere in any document, from the manufacturer as incentives or gifts on achieving certain sales targets. These will be in many forms viz. jewellery, conducted tours, luxury cruises, group parties in star hotels, costly gifts and the like apart from cash also. The benefits given to dealers / retailers are not termed as discounts whether primary or secondary. The circulars No. 92/11/2019-GST dated 07/03/2019 and No. 105/24/2019-GST dated 28/06/2019 has left out this vital form of transaction used by the electronic industry to pass on the benefits to the dealers and thereby escaping the GST radar.

Hitherto under Section 4 of the Central Excise Act 1944, Transaction Value was defined to mean the price actually paid or payable including any amount that the buyer was liable to pay in connection with the sale whether payable at the time of the sale or at any other time, including, but not limited to, any amount charged for advertising or publicity, marketing and selling organisation expenses, storage, outward handling, servicing, warranty, commission or any other matter. Further Rule 6 of CEVA stated that value of goods shall be deemed to be the aggregate of the Transaction Value including money value of any additional consideration flowing directly or indirectly to the buyer. This inclusive definition got into the ambit of TC any amount received by the dealer from manufacturers even subsequent to the original transaction, on account of any reason. These would invariably accrue to the dealer "in connection with the goods sold". These monies or money equivalent will be additional consideration flowing either directly or indirectly from the seller to buyer. The provisions of Rule 6 of the Valuation Rules extended to discharge of sales obligations both in the present and future and would include the amounts paid by the manufacturers to dealers in relation to sale of goods subsequent to the sale. The expressions/terms used in the amended Section 4 to hold that the TV was wide enough to include all elements integrally connected with the sale of excisable goods to be part of the transaction value including the consideration flowing post sales.

Coming to GST levy as per section 15 of the CGST Act, the value of a supply is the transaction value actually paid or payable for the supply and includes any amount that the supplier is liable to pay in relation to such supply. It includes incidental expenses, including commission and packing, charged by the supplier to the recipient of a supply and any amount charged for anything done by the supplier in respect of the supply of goods or services or both at the time of, or before delivery of goods or supply of services. The words amount paid / received subsequently / after the initial transaction, but in connection with the sale is conspicuously absent in this provision. As per section 15(3), value shall not include any discount given before or at the time of the supply if such discount has been duly recorded in the invoice issued. If discount is given after the supply, then it had to be agreed upon at or before the time of such supply and specifically linked to relevant invoices. So, any discount that is not known or specified or recorded before or at the time of supply cannot be part of the transaction value. In this case the amount / gift does not have the nomenclature of discount and also is not known/ specified at the time of initial supply either by the manufacturer or by the dealer. Further, there are no credit / debit notes issued as per section 34 of the CST act by the manufacturer in the name of the dealer and the monies incurred are booked as expenses to the manufacturer himself.

The circular 92/11/2019-GST dated 07/03/2019 clarified that samples and gifts supplied free of cost, without any consideration, do not qualify as supply under GST, except where the activity falls within the ambit of Schedule I of the said Act. Further the circular 105/24/2019-GST dated 28/06/2019 clarifies that if the post-sale discount is given by the supplier of goods to the dealer without any further obligation or action required at the dealer's end, then the post sales discount given by the said supplier will be related to the original supply of goods and it would not be included in the value of supply, in the hands of supplier of goods, subject to the fulfilment of provisions of sub-section (3) of section 15 of the CGST Act. However, if the additional discount given by the supplier of goods to the dealer is the post-sale incentive requiring the dealer to do some act like undertaking special sales drive, advertisement campaign, exhibition etc., then such transaction would be a separate transaction and the additional discount will be the consideration for undertaking such activity and, therefore, would be in relation to supply of service by dealer to the supplier of goods.

In the above mentioned instances, the dealer receives monies / gifts / incentives in various forms (foreign trips) from the manufacturer calculated based on the sales volume. However, the quantum of such monies or benefits was not informed or calculated or even mentioned by the manufacturer at the time of or before the supply. For this reason, it does not fall under the ambit of section 15 of the CGST Act. Here, the dealer being the receiver of this benefit does not have any obligation to any act post sales for or on behalf of the manufacturer, hence is outside the ambit of circular dt. 28/06/2019. The vital aspect is though the amount/ gifts received by the dealer from the manufacturer is directly related to the sale of the goods, the provisions of CGST Act read with circulars quoted above does not consider this as consideration since the same was not known or specified /described before or at the time of supply. In fact, it is clarified that this unless proved is in connection with the supply, cannot be consideration for the supply that is made earlier.

The manufacturer has to include the money value of these benefits / gifts given to the dealers in the Transaction value of the goods that were earlier sold to the dealers who supplied them at less or no margin. This loop hole could be used to evade GST on amounts in connection with supply. It is felt that this important part of the transaction that was taken care in the Central Excise Act can miss the GST levy if the terms "payable at the time of the supply or at any other time in connection with the supply of goods or services" is not included in the section 15 of CGST Act.

(The author is an Auditor & Tax Consultant and the views expressed are strictly personal.)

|